Plug and Play Japan has selected 94 domestic/overseas startups for its Winter/Spring 2020 Batch

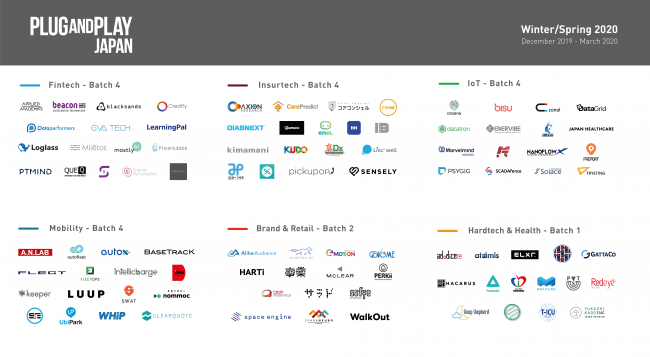

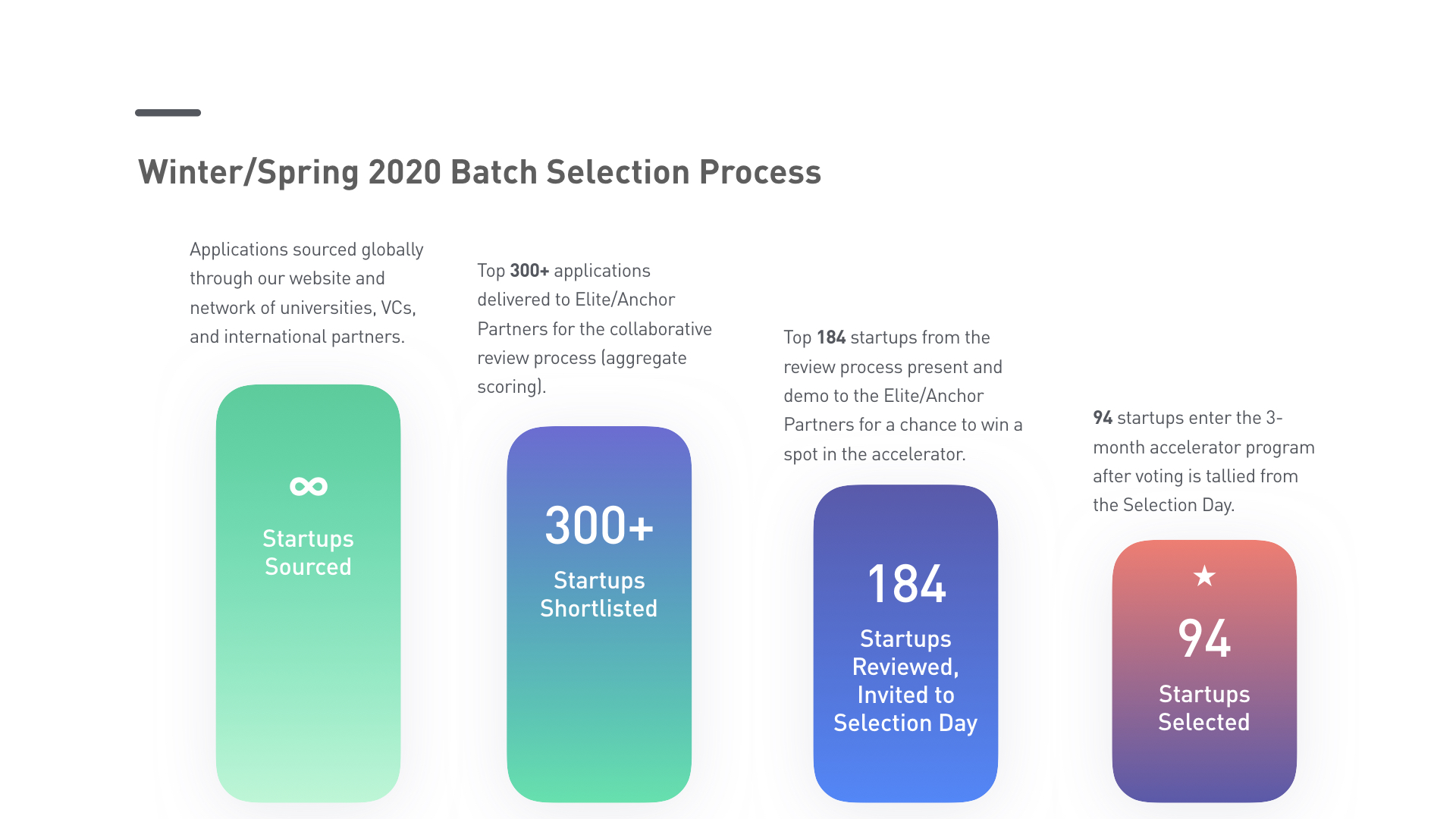

Plug and Play Japan KK (Japan office: Shibuya-ku, Tokyo, Representative: Phillip Vincent, Hereinafter called; Plug and Play Japan) has selected 94 startups in 6 verticals (IoT, Fintech, Insurtech, Mobility, Brand & Retail and Hardtech & Health ) together with 36 large domestic corporate companies for the Winter/Spring 2020 Batch acceleration program, which will be carried out from December 2019 to March 2020.

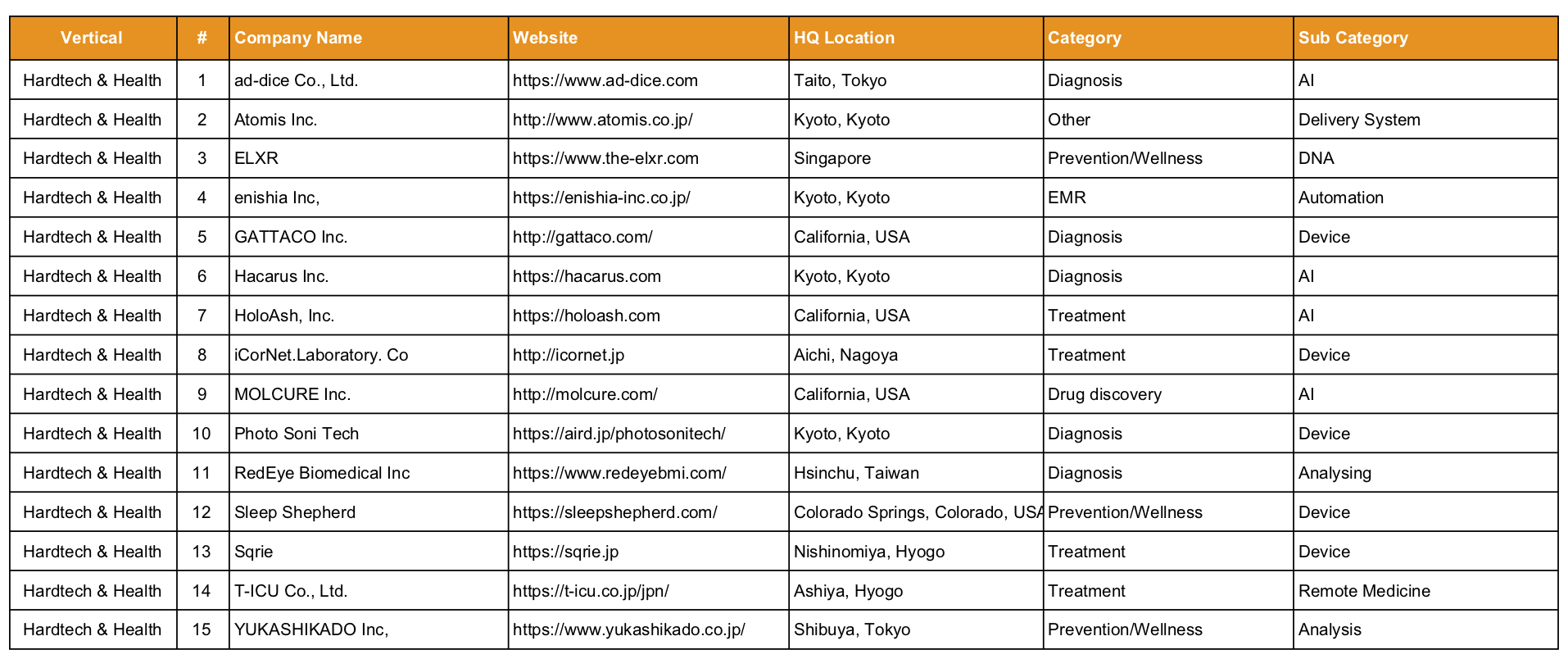

In Winter/Spring 2020 Batch, the new program “Hardtech & Health” in Kyoto, our new location, is finally beginning.

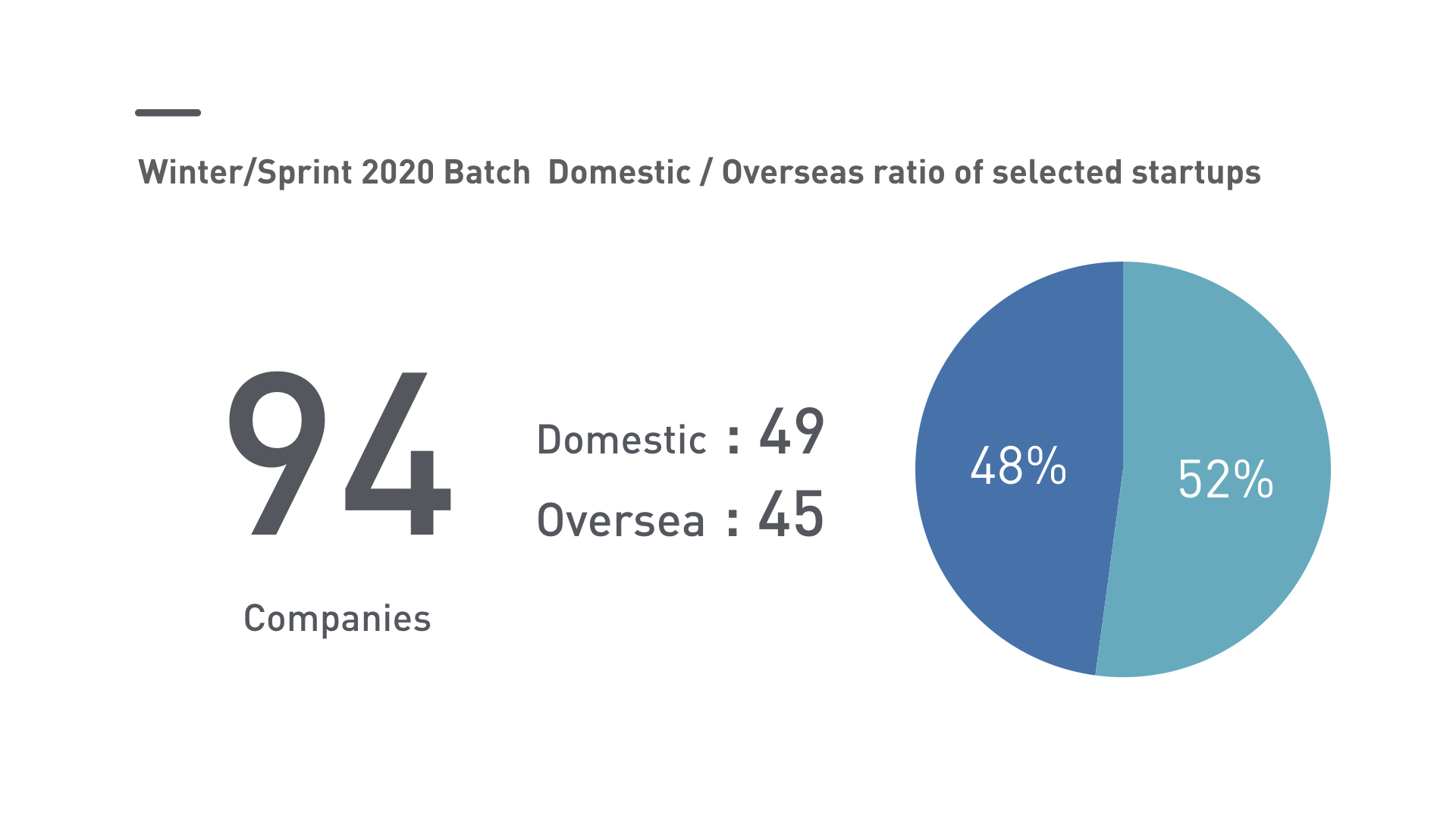

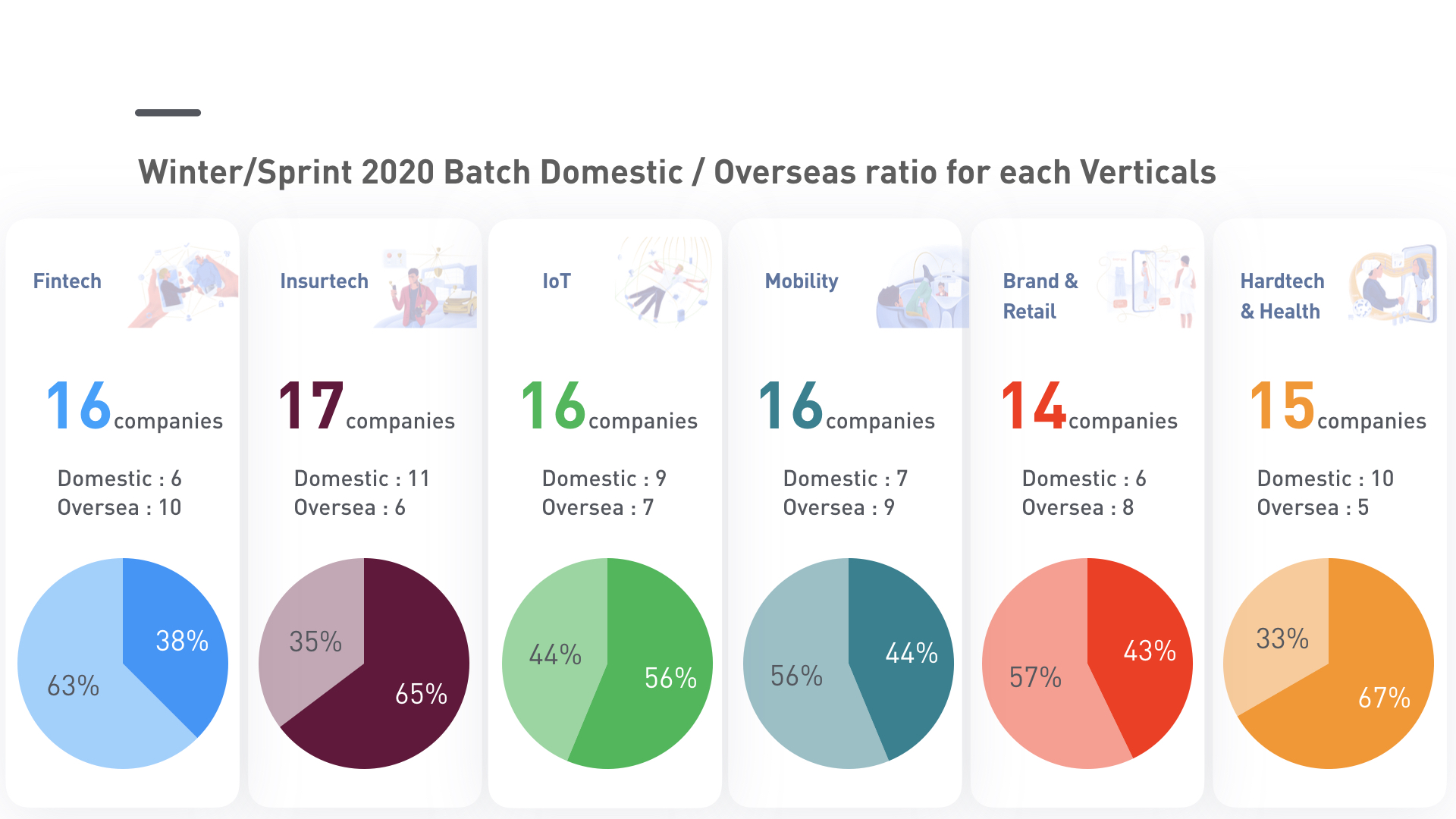

The ratio of domestic / overseas startups selected this batch was 52% in Japan (49 companies) and 48% overseas (45 companies). The ratio of each vertical is as follows.

In the “Summer / Fall 2019 Batch” acceleration program implemented in the June-September period of 2019, 31 major domestic companies that are official partners in five fields (IoT, Fintech, Insurtech, Mobility, and Brand & Retail) At the same time, we supported 69 startups in domestic and overseas.

At Summit (generally called Demo Day) held at the Toranomon Hills Forum on September 18th and 19th, 61 selected startups shared their experiences from the program. 2,004 attendees were present at the two day event.

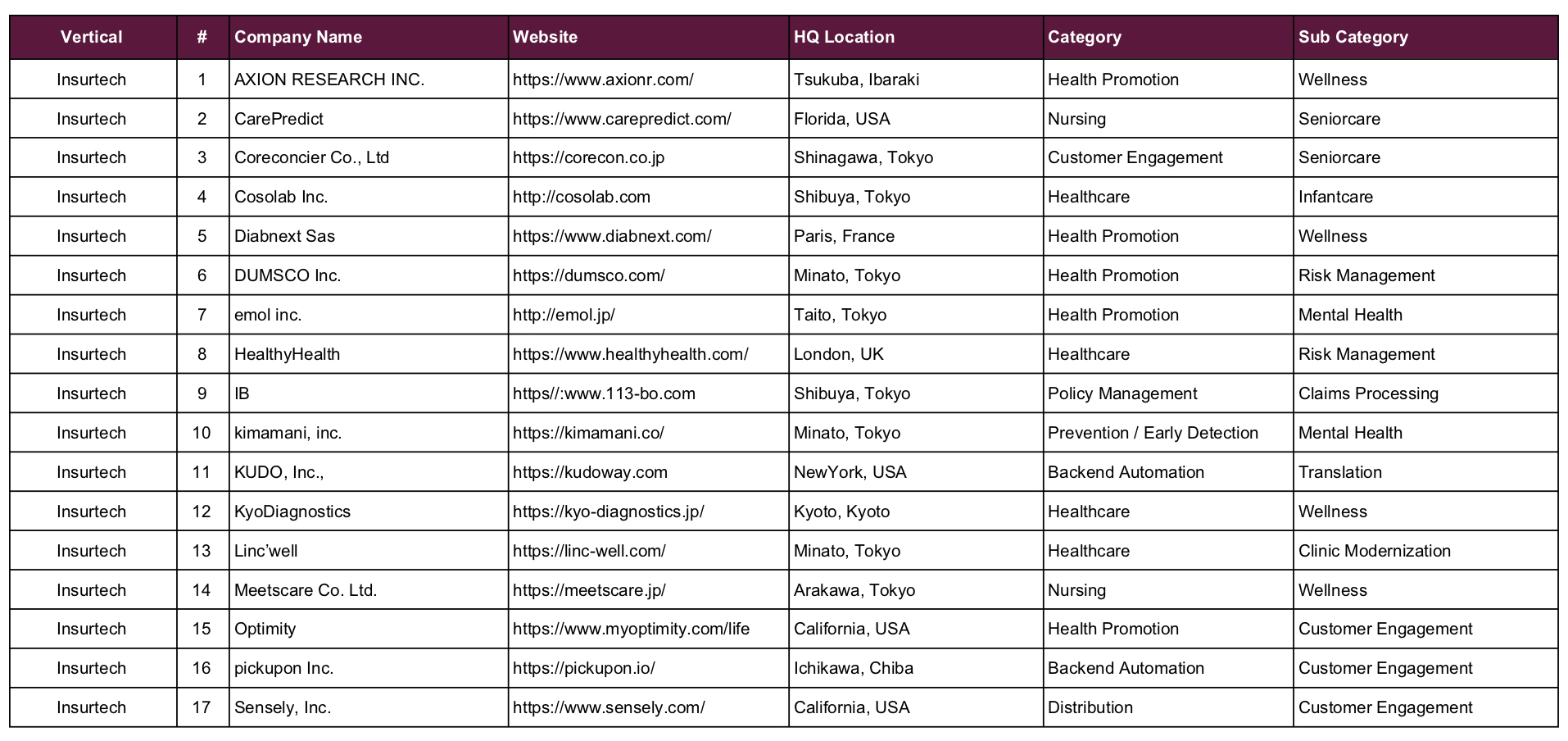

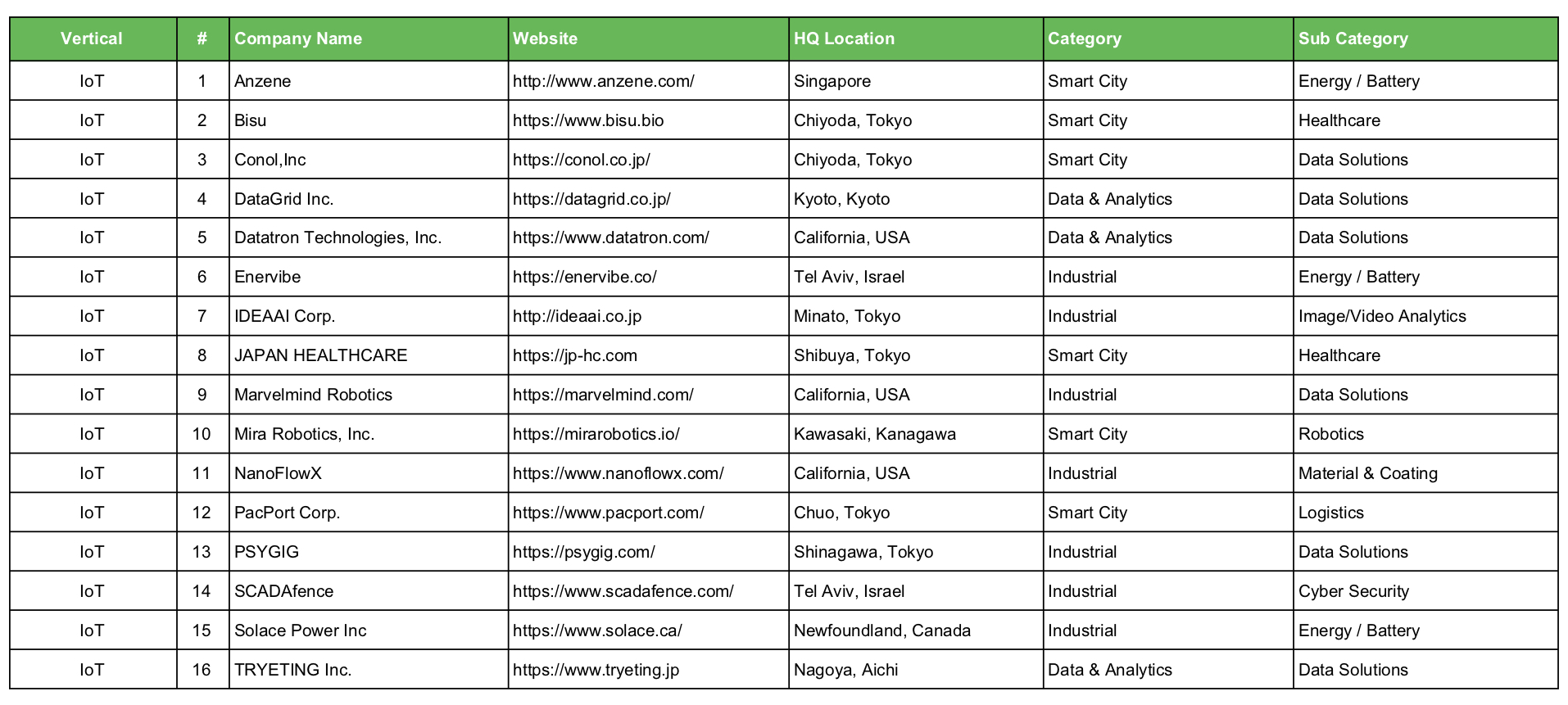

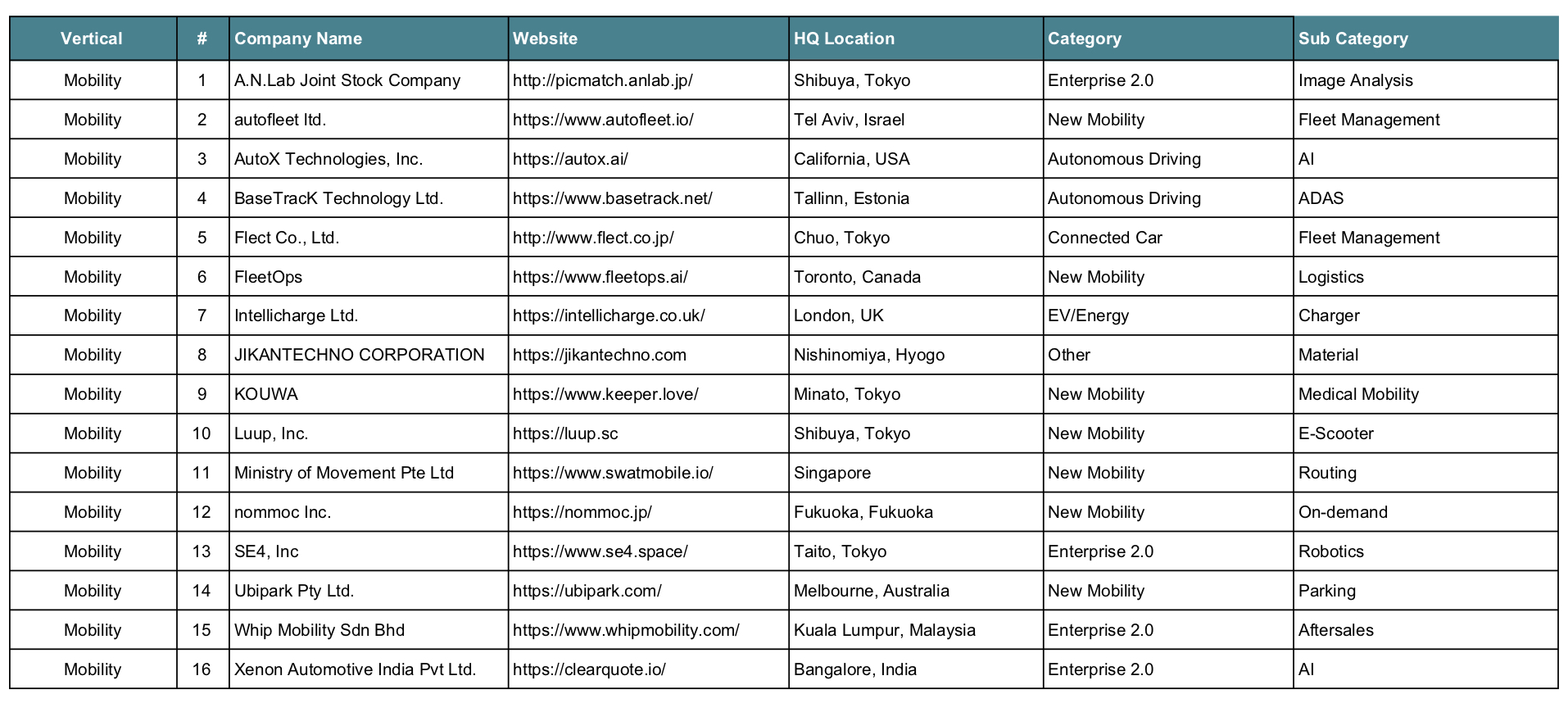

The startups that have been selected for Winter/Spring 2020 Batch are as follows;

Also, we will hold Winter/Spring 2020 Batch on March 5th (Thu) and 6th (Fri) in Tokyo, March 17th (Tue) in Kyoto to announce the result of the 3-month program, Winter/Spring 2020 Batch.

[ Our Corporate Partners (as of December 5th, 2019)]

About Plug and Play

Plug and Play supported more than 560 startups in its US Headquarters and 1,100+ startups around the world with 222 investments made through its acceleration programs in 2018. It currently has 750 active portfolio companies including Guardant Health, Honey, Soundhound, Zoosk, and more. Successful portfolio exits include Dropbox ($11 billion valuation at IPO), PayPal (acquired by Ebay), Vudu (acquired by Walmart), Danger and Powerset (acquired by Microsoft), Lending Club ($9 billion valuation at IPO), and the most recently Guardant Health ($1.6 billion valuation at IPO).