Democratizing Alternative Investments to Elevate Japan's Investment Standard - LUCA Japan

2023/01/16

Within the investment industry, publicly traded stocks and bonds are referred to as traditional assets, while investments in assets that do not fall into those categories are called “alternative investments”. Because of its wide variety of products which caused financial literacy disparities, alternative investments have been accessible only to a limited number of expertised investors so far.

LUCA Japan provides a digital platform to complete the complex investment process, based on the concept of “bridging the gaps in alternative investments”. We interviewed Ms. Keiko Sydenham, Co-founder and CEO, about the company’s mission and vision to revolutionize the investment environment in Japan.

Writer: Yoshito Tanaka

Profile

Interviewee: Keiko Sydenham

Co-founder and CEO, LUCA JapanKeiko has been engaged in hedge fund investment since 2000 before she joined the Japan office of a U.S. investment management company as a relationship manager for institutional investors responsible for strategy briefings, fundraising of alternative investment funds including private equity, real estate, infrastructure, and private credit. After serving as Head of Alternative Investment Strategy at JPMorgan Asset Management and Managing Director at Blackstone Group, she joined LUCA as a founding member in 2021. She holds a Master’s degree from Johns Hopkins University’s School of Advanced International Studies.

Interviewer: Jingqian Ma

Plug and Play Japan Head of VenturesAfter graduating from university, Jinquan Ma joined EY and engaged in consulting services related to transfer pricing, global expansion, and M&A. He then worked at Morgan Stanley MUFG Securities and SBI Investment, where he was in charge of investing in fintech, AI, and SaaS companies. As a lead investor, he served on the board of several portfolio companies and provided hands-on support to lead them to exit. In 2021, he joined Plug and Play Ventures as the Head of Ventures, overseeing all investment activities in Japan.

Bringing "Alternative Investments" to more investors

--First things first, please tell us what LUCA Japan does.

LUCA Japan is committed to “bringing Japan’s investment standards to a global level”, and we hope to achieve this mission through an asset class called “alternative investments”.

The term “alternative investments” refers to investments in targets that differ from traditional targets, such as stocks and bonds. Examples are private equity, venture capital, hedge funds, commodity funds, real estate, and other instruments that can be used to fund a company. These are generally considered to be uncorrelated with stocks and bonds, and incorporating alternative investments into a portfolio is expected to provide risk diversification.

For a long time, alternative investments have only been accessible to a limited group of investors, such as institutional investors. Our goal is to offer these investments to a wider range of investors.

In particular, we believe that there are many small and medium-sized financial institutions and foundations, such as regional banks and Shinkin (deposit institution) banks, that are aware of the issues but have not found a solution. There is a large information gap on alternative investments, but technology can bring information transparency, so we would like to propose better access to such information.

--I have seen some cases with insufficient knowledge and know-how in investment management. Especially when it comes to alternative investments, I have an impression that Japan is lagging far behind compared to other countries.

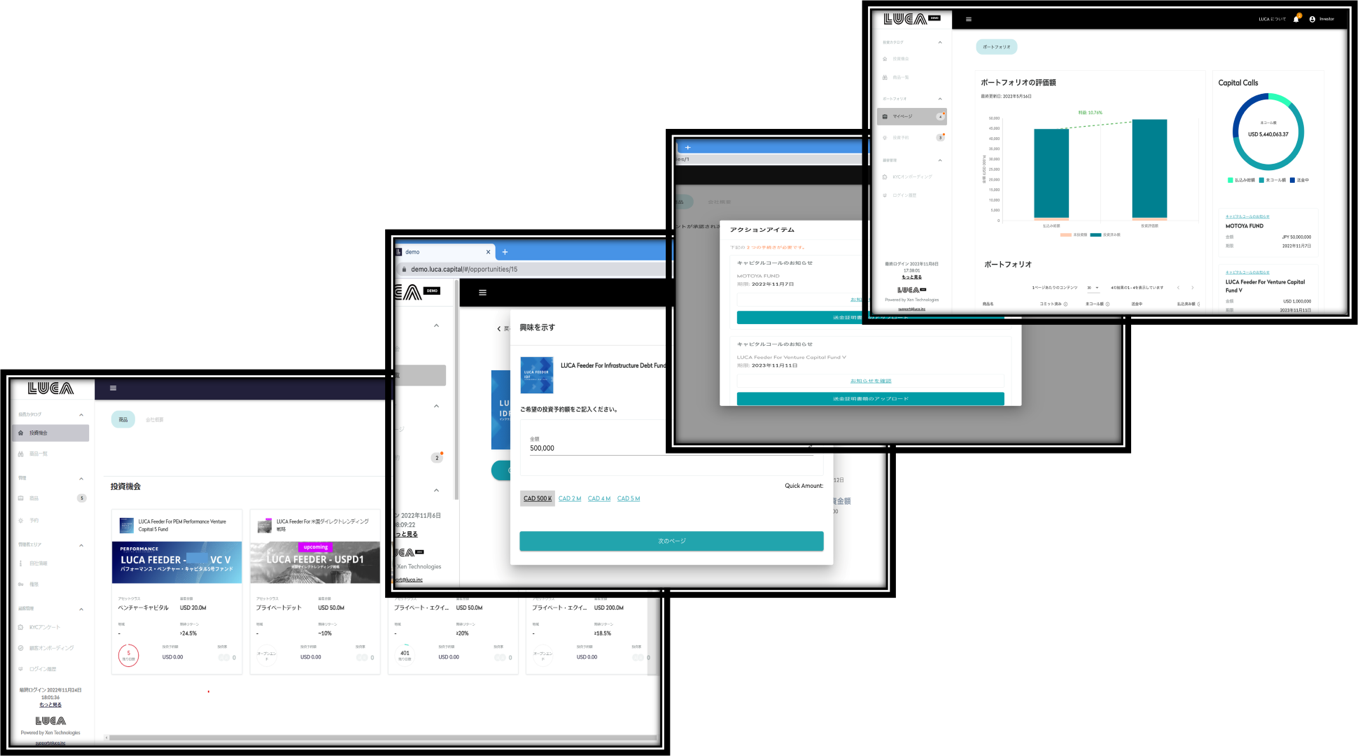

Technology is the key to change this situation. We are committed to creating a world where a wider range of people, including individual investors and high-net-worth clients, can access alternative investments through a digital platform that facilitates efficiency and scale in administrative work through digitization and enables a one-stop, online completion of complex investment processes.

Making "Alternative Investments" Easier with the Power of Technology

--What was the motivation for you to start a business in Japan, given your own experience in alternative investments?

There are two main reasons. One is that the alternative investment process was all too complicated. It is universally so but in Japan in particular, digitalization has not made much progress including investors For example, there was a lot of manual procedure involved in retrieving information from portals, and it was very time-consuming. Moreover, due to the language barrier, it was taking a considerable amount of time to carefully examine the content of each individual product which could have been easily simplified by digital technology. Even a non-IT professional like myself wondered, “Wouldn’t it be more convenient if we used technology?”

Another reason was that I wanted to offer better investment opportunities to non-institutional investors. One of the ways to achieve this goal was to establish an alternative investment business.

--It is said that alternative investments are more strictly regulated in Japan than in other countries. How do you think the alternative investment industry in Japan will change in the future?

Alternative investments, as its name implies, have not been mainstream areas of investment. There are always new innovations in investment strategies. Just when you think regulations have been eased, scams or other misdeeds occur and regulations get tightened again, the situation is constantly changing. However, we believe that it is important to protect investors and keep them well informed. Therefore, it is crucial to create a framework to prevent people from being misled. For instance, having enough financial literacy should be required even if the regulations were eased.

When the investment industry as a whole grows to understand the purpose of alternative investments in the future, better investment opportunities will be found. It is our role to help stimulate this movement, which we call the “democratization of alternative investments”.

Impact of the Weakening Yen on Alternative Investments

--It would be great to see more education efforts from the people who are already in the industry to increase access to alternative investments for those who are not too familiar.

Absolutely. I can see the number of people who are interested in alternative investments is growing. But at the same time, there has been an increase in the number of people who are introduced to investment projects secretively, in a “this is just between you and me” kind of way. Due to the nature of alternatives, a variety of products are produced, but not all of them are of high quality.

The first thing we at LUCA would like to advocate is “Institutional Quality”, meaning LUCA brings the trusted investment opportunities in a trusted way. Institutional investors have a high level of trust in managers that they have been working with for a long time, and investors trust them in ways other than performance and numerical profitability. A sense of security is essential to the first step in investing, and we hope to be recognized as a leader in this area.

Unfortunately, the number of people in Japan who are able to choose their own targets is still overwhelmingly limited. In order to increase this number, we believe that the healthiest way is people in the industry like us to provide information in a highly transparent manner.

--I believe that in the alternative investment market, you are expected to provide opportunities for domestic investors to access overseas funds and vice versa. What impact do you think the weak Japanese yen will have on your business?

Since it is a long-term investment, there is little market linkage to begin with, so we are not disturbed only by the ups and downs of the exchange rate. But it may appear to overseas investors that valuations have become even more undervalued. On the other hand, there are many Japanese venture capitalists who do not have IR for overseas investors, so it is quite possible that we can serve as a hub for them and promote overseas fundraising.

Japanese investors who hold yen may become a bit hesitant about investing abroad, but I think it is important to consider the option of holding foreign exchange other than yen from the perspective of long-term holdings.

Strength of LUCA Japan

--How do you see opportunities in overseas markets?

The first step would be connecting Japanese domestic investment management companies (e.g. venture capitals, private equities) to overseas markets to raise funds globally.

On the other hand, we believe that Asia has plenty of potential as a platform for attracting investors. There will be multiple factors come into play such as demographics, the presence of wealthy individuals, and the availability of digital knowledge. But we would like to expand to international markets with high potential, for instance India.As for progress, the beta version of the LUCA platform is about to launch, so we are finally getting people to consider it as an investment opportunity. Right now we only offer one fund, but we are gradually increasing the number of funds, and we would like people to experience it.

To achieve this, we are looking to expand our team as well. We would like to hire more engineers in particular. Until now, we have relied on outsourcing, but in order to respond quickly to the needs of the market, we would like to move forward with in-house production.

--Are there any competitors in Japan?

We do not believe they are in Japan at the moment, but overseas platformers are getting bigger and bigger. It is quite likely that they will enter the Japanese market in the future.

However, there is no need for customers to be limited to one platform at all. We believe it is important to increase the number of platforms, both domestic and international, and to raise awareness of the industry as a whole.

--What do you see as LUCA Japan's competitive advantage?

We have several advantages. We have experts who have a deep understanding of Japanese investors, we provide detailed explanations and education to investors, and we have access to overseas markets for our clients. Among these, the greatest strength of the company is its thorough knowledge of the alternative investment market in Japan.

Japan is a very complex environment, including regulations, and the stakeholders and players are divided into very specific markets, making it difficult to adapt to only one major policy. We want to develop our business in a way that matches the needs and scale of the public.

Bringing Japan's asset management market up to world-class standards

--Please tell us about your future investments. What led you to accept Plug and Play's investment and why?

We have always been actively seeking fundraising opportunities from global investors. When we expand into the international market in the future, it would be very reassuring to have support and advice on global startup perspectives and trends, so we chose a company that has expertise in this area.

The other reason is the influence of the Plug and Play brand. As Plug and Play provides a wide range of businesses, including accelerators, that are not found in most venture capital firms. We figured that we would eventually have many opportunities to consult with Plug and Play.

--Thank you very much. As you said, we started out as an accelerator and then began to focus on venture investment as well. For example, we are actively introducing our portfolio startups to major companies through our accelerator programs, and we would like to provide various types of support to your company from our platform as well. Lastly, what is your vision for the future of LUCA Japan?

In order to raise Japan’s asset management market to a world-class level, we would like to make alternative investment products pervasive in portfolios. In the Japanese market, many people still ask; “What is an alternative investment?” So we would like to change that response to, “Oh, I am doing alternative investment”.

With Japan’s pension shortage issue, the so-called “20 Million Yen Retirement problem”, long-term asset building is becoming extremely important. Our goal is to promote alternative investment by spreading the viewpoint of long-term asset management, which has been unavailable other than to institutional investors and thereby changing the existing business model.

And also we are looking for overseas expansion. We are considering expanding our services to regions outside of North America and Europe. We believe that the concept of “promoting the Japanese market to overseas” will become increasingly important. We would like to create a trend where overseas investors take an interest in Japanese venture capital and, by extension, the companies in which they invest, creating synergies. We hope to fill the gap between Japan and other countries to achieve fair access and fair asset management.